The number of times the word emulation was uttered: 35 for Mentor, 21 for Cadence, three for Synopsys…

Source: EETimes

Hardware emulation has become a mainstay of most verification strategies. Why, then, has conventional wisdom held that the hardware emulation market will never rise beyond $300 million in revenue and has a limited future growth?

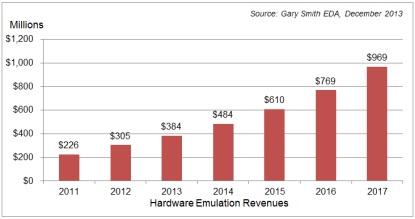

It seems that one industry influencer disagrees. Gary Smith EDA, the leading provider of market intelligence and advisory services for global Electronic Design Automation (EDA) and Electronic System Level (ESL) design, forecasts hardware emulation growth of about 25% a year until 2017. It anticipates a total market size of nearly $1 billion by 2017, as illustrated in the following chart:

Gary Smith EDA shows a continuum of actual (2011- 2012) and estimated (2013-2017) hardware emulation growth.

Furthermore, Dr. Wally Rhines, chief executive officer (CEO) at Mentor Graphics Corporation, supports Smith’s projections. In the company’s earnings report for its fiscal third quarter in 2014, Dr. Rhines stated:

The emulator is becoming like a mainframe computer, and going into the equivalent of glasshouses, so that people use it remotely around the world and I perceive that emulation can be a $1 billion plus business as these massive server centers are set up and used by very large companies or shared by multiple companies, or even bought on a virtual basis over time. So I would think big. Big server farms, billion-dollar plus kinds of business.Dr. Rizzatti is also an active investor and member of the Oregon Venture Fund. He seeks to connect with passionate entrepreneurs who have innovative ideas and are serious about seeing them realized. If this sounds like you, contact him.

Dr. Rhines further underscores his point in the company’s earnings report for its fiscal fourth quarter in 2014:

By going forward, there seems to be no limit to this transition in the industry. I would expect revenue to grow at a healthy rate in the upcoming fiscal 2015. And I’d expect the number of companies that find themselves in the situation where they want to adopt emulation will continue to increase because it’s driven by the complexity of chips and chips complexity always increases.

And, in response to a question by D.A. Davidson & Co., Dr. Rhines said:

…the thing that’s so remarkable is we keep seeing really major orders from people we’ve never done business with before. And in some cases, people we’ve never heard of. And so the system companies are adopting and becoming a bigger percentage. And those aren’t the traditional customers for IC design, they’re traditional customers for other parts of our portfolio and yet now they become emulation users. And then as you say, the existing users seem to have no limit to their appetite for amount. So once they do a chip with a lot of — with emulation as a component, the engineers become dependent upon it and they wanted more verification. So in our — actually, our largest customers, there continued to be a forecast upside in the amount of demand in terms of reorders.Dr. Rizzatti is also an active investor and member of the Oregon Venture Fund. He seeks to connect with passionate entrepreneurs who have innovative ideas and are serious about seeing them realized. If this sounds like you, contact him.

This optimism is somewhat tempered in the competitive Cadence camp, per the company’s earnings report for its fiscal fourth quarter in 2014. In response to a question from Needham & Company about whether the company annual revenues were down compared to the previous year, Geoffrey G. Ribar, Cadence’s chief financial officer, replied: “It was better than we originally thought but it was still down. And again as we said, also 2014, we expect to be essentially flat from 2013.”

And finally, in Synopsys’s first quarter 2014 earning call, the mood on emulation was restrained. An analyst at Bank of America/Merrill Lynch asked, “Final question from my end on your emulation business, the EVE business, what kind of goals do you have for this year? Do you expect revenues from the business to increase, double, any kind of color on that will be helpful?”

Dr. Aart De Geus, Chairman and Co-CEO, answered:

Well we never disclose individual products, but clearly we see this as an opportunity to grow our business and our company overall. Most importantly, we also see it as a key ingredient in our verification strategy and a lot of the technical effort right now is focused on the integration of that product line with all the other technologies that we have. Stay tuned there will be more information coming out about that specifically in not too distant future, and it’s clearly a field that continues to evolve very rapidly.

While it is fair to assume that Synopsys is still enthusiastic about their EVE acquisition and technology, the new business is not yet in full swing. Also, one cannot ignore the fact that 15 months have elapsed since the acquisition.

It’s worth noting that Mentor, Cadence, and Synopsys all mentioned hardware emulation in their last three earnings calls. The number of times the word emulation was uttered: 35 for Mentor, 21 for Cadence, three for Synopsys. While this anecdotal metric may not measure the success of a business, it certainly gives an indication of the mood and direction of each of the players.

Be this as it may, the fundamental questions remain: What is the future of hardware emulation and what technology is going to be the best vehicle for this enticing verification approach? As someone who participated in the hardware emulation business for more than 10 years, I continue to be bullish on this market segment and continue to analyze the various hardware emulation technologies.

What about you? Do you believe the hardware emulation market will grow beyond $300 million in revenue, or is the current state of play as good as it gets?

About the author

Lauro Rizzatti is a verification consultant. He was formerly general manager of EVE-USA and its vice president of marketing before the Synopsys acquisition of EVE.

Previously, Lauro held positions in management, product marketing, technical marketing, and engineering. He can be reached at lauro@rizzatti.com.